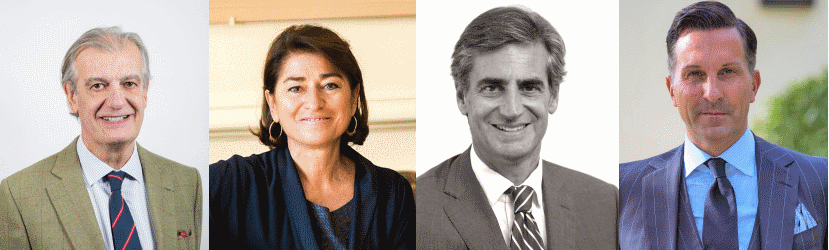

Four top-end real estate professionals analyse developments in the Paris property market for Figaro Properties.

Charles-Marie JottrasCEO of Daniel Féau

What is your assessment of the 2018 Paris property market?

We broke a new record with a 32% increase in turnover compared to 2017. All the neighbourhoods where we work saw double-digit growth with significant performances in western Paris and particularly in the 16th, which is becoming fashionable again. The large apartments in the beautiful Haussmann-style buildings in the north of the 16th are highly liveable when properly renovated. Passy and Auteuil benefit from good quality schools – a key purchasing criterion for potential buyers – as well as good family-sized apartments.

What were your best sales?

In the 16th, a sunny five-bedroom apartment with great views over the Seine and the Eiffel Tower, which sold for 6,500,000 Euros. In the Georges-Mandel neighbourhood, we sold a 380-square-metre apartment on a high floor for 5,900,000 Euros. And in the 7th district - Champ-de-Mars Eiffel Tower - an elegant apartment with a private garden and spectacular views of the Eiffel Tower went for 8,920,000 Euros. The record amounts of the year: €25,000,000, €18,500,000 and €13,500,000.

What is happening to prices?

In this fluid market, there is a strong imbalance between supply and demand particularly for three-bedroom apartments under 150 m². This imbalance is partly fuelling the rise in the price per square metre especially for family properties priced at between 1 and 2 million Euros where we saw an increase of 5.4% over the year. In 2018, our agencies sold three family apartments a day in Paris for an average price of €1,830,000 (i.e. an average price per square metre of €13,550). Sales of apartments and private houses worth over 4 million Euros went for an average price of €18,849 per square metre with a record price of €39,294 per square metre for a renovated and decorated apartment with breathtaking views of the Seine and Paris.

What are the major trends?

Brexit has had a significant impact on the Paris market and the nearby western suburbs: purchases made by French expats living in London due to the relocation of their offices to Paris account for a growing number of sales. The majority of these Brexiters have bought properties priced at between 1.5 and 3 million Euros, generally family homes close to schools in Paris or Neuilly. We have seen an unprecedented flow of non-resident buyers and the number of French nationals selling their Parisian residences to settle abroad has almost ground to a halt over the last year and a half.We have concluded dozens of sales with buyers from London, often working in finance, who are leaving the British capital to move to Paris as a result of or in anticipation of relocating their business following Brexit. In the Paris market, already under pressure from high demand, this new clientele will only exacerbate the problem.

How is 2019 looking for your sector?

Our perspectives, based on current transactions, are in line with the second half-year period of 2018. Everything points to more and more clients coming from London.

Nathalie GarcinCEO of the Émile Garcin Group

What is your assessment of 2018?

In 2018, our turnover was up by 15% compared to 2017. There was a shortage of properties driven by the ever-increasing demand especially for high-floor apartments with views and outside areas; these properties require a budget similar to that for a high end property. In detail: 30% of transactions were for properties under a million Euros; 32% for properties between 1 and 3 million Euros, and 38% for properties above 3 million Euros. 70% of buyers are French, 20% are from the European Union and 10% are from outside the EU. 90% of vendors are French, 6% are from the EU and 4% are from elsewhere. The dynamics of the market have resulted in numerous transactions over 3,000,000 Euros on the Ile Saint-Louis and in the Marais. We also sold a number of quirky charming properties located in cul-de-sacs in the trendy new Haut Marais area. Very attractive interest rates are also driving sales. The demand for quality rare properties is still very high (top floor, balcony and garden).

What were your best sales in Paris?

Among the most notable was a 700-square-metre house in La Muette (16th) with a garden that sold for 11 million Euros. In the 4th – Quai d’Anjou – a 180-square-metre property that sold for 3.5 million Euros. On the Ile Saint-Louis, in a beautiful building designed by Louis Le Vau (the architect of Hôtel Lambert), we sold a beautiful duplex apartment with a reception and family room overlooking the Seine. Its Versailles-style parquet, high ceilings and numerous windows overlooking the Seine made this a truly outstanding property. On the Left Bank in Saint Germain des Prés, a 250-square-metre garden apartment sold for 7.5 million Euros.

What are the major trends?

The most sought-after properties: outstanding apartments, private houses located in the Golden Triangle or in Trocadero but also in private lanes, and properties with views or located on upper floors with balconies. But Paris is Paris and despite events of recent months, buyers are not put off. They are mainly French including a lot of expats looking to invest in medium and large properties in Paris. International clients (American Japanese and Brazilian) are also looking to buy. We have noticed certain districts, such as the 10th and 11th, becoming more popular thanks to their lively neighbourhoods and villagey feel. In terms of Brexit, we have already seen an initial wave of Brexiters but there will be a second and bigger wave if Britain actually leaves the EU. Brexit has also boosted the rental market. Foreign buyers (American, Asian and English) are attracted to the history and beauty of the French capital. In addition, there is still a market for family homes i.e. close to schools and shops, which accounts for 50% of sales. In this context, apartments between 150 and 300 m2 are the most sought-after. The main trends for western Paris (Neuilly, Boulogne, etc.) are family apartments measuring 120 to 180 m² with at least three bedrooms. Families want proximity to good private schools, shops, the Bois de Boulogne and a Metro station.

In your opinion, where are there opportunities for luxury properties in Paris?

The difficulty in the high-end market is to find that rare pearl - one with zero faults. There are opportunities in trendy districts, such as south Pigalle or Haut Marais, areas near Paris’ most expensive districts e.g. the Marais or the beautiful 9th. There are still a lot of opportunities in the 16th.

How is 2019 looking for your sector?

2019 is looking very promising as the demand is still high. In the short-term, interest rates remain unchanged and this is fuelling transactions. For the moment, the IFI has not had a significant impact. We are resolutely optimistic! Real estate continues to interest our clients and remains a sound investment. While the tax burden did drive some clients abroad, they are now starting to come back! Due to the scarcity of available property, as soon as we put a high-quality home on the market, it sells immediately and for the asking price.

Richard TzipineManaging Director of Barnes

What is your assessment of the 2018 Paris property market?

2018 was a very good year in terms of activity in Paris. Our sales rose by 25% following an increase of 20% in 2017. This is due to the very high demand for properties. Price reached record levels (+ 8 % on average in 2018), vendors have understood that the moment to sell is now and there are plenty of buyers ready to offer the asking price if the conditions are right. In certain districts, even if there is now a better balance between supply and demand,the phenomenon of flash sales continues (sales completed in under 72 hours). In 2018, we completed 152 sales of this type compared to 74 in 2017.

How are prices changing and what are the trends?

We completed over twenty sales of above 6 million Euros, with a record of 30 million Euros for an 800-square-metre property on the Left Bank. We see prices reach up to €30,000/m2 for exceptional pied-à-terres in the 8th arrondissement, up to €21,000/m² in the Marais or the 8th for exceptional apartments on the top floor with beautiful views. Prices have risen sharply i.e. by around 8% for luxury real estate. Districts in the centre of Paris (3rd, 4th and 11th) and further north (9th and 18th) have seen the biggest price increases reaching €15,000/m2 on average in the Marais with several sales over €25,000/m2, and average prices of €12,000/m2 in popular areas in the 9th and 18th. In Rue des Abbesses, we completed a sale at €22,000 per square metre for an apartment with panoramic views of Paris. This was a record in this area. Some areas like the 16th, which were overlooked by young families a few years ago, are now becoming attractive again. We have also noticed a ‘Brexit’ effect since 2016: we regularly sell family apartments to French expats planning to return to France, usually in the 7th, or on the Right Bank in the 8th, 16th, 17th districts and even in Neuilly. According to our annual survey, Paris is ranked 5th on the list of the most popular international cities for UHNWIs just ahead of London, which is absent from the top five most desirable cities for the first time. However, since December we have noticed a change in attitude in terms of overseas clients. Some have decided to postpone their decision to buy until they know what is happening with the ‘yellow vests’.”

In your opinion, are there opportunities for luxury properties in Paris?

Definitely not for professionals or those wishing to turnaround properties in a short time. However, there is a real opportunity for clients with exceptional properties as the inventory is very high. Prices having risen considerably and many owners are taking the decision to sell their property. As far as buyers are concerned, we can see that the demand for ‘exceptional’ properties has never been higher for both French and foreign investors. In 2018, Paris has become ‘the place to be’.

How is 2019 looking for your sector?

January was excellent. The short-term international economic analysis does not paint a picture of a world economy in excellent health due to multiple political, economic and financial threats depending on the continent or country. More than ever, real estate remains a safe haven especially in the context of the recurring issue of French taxation - our Achilles heel. Our segment remains high-end real estate. In this niche market, demand will remain high thanks to the new appeal of Paris. Even if interest rates rise and the social protests continue, Paris should continue to attract French and foreign buyers in 2019. If certain market elements were to become more fragile, this would make it possible to rationalise and strengthen the market. We remain optimistic for this year with prices that should stabilise.

Alexander Kraft, CEO of Sotheby’s International Realty France

What is your assessment of the 2018 Paris property market?

In 2018, Paris was undoubtedly the most active market in France. Taking advantage of low interest rates and the continued buoyancy of the market, buyers had a budget well above that of 2017: the average sales price in our Paris agencies was 2.52 million Euros i.e. an increase of almost 50% compared to 2017. The pace of sales has also broken records. In the second and third quarters of 2018, quality properties at the right price sold in under 24 hours, a phenomenon that was common in London and New York in the boom years! In 2018, our 50 branches received 3,492 new instructions to sell at an average price of 2.43 million Euros, for a prestigious property portfolio valued at more than 8.18 billion Euros.

What were your best sales?

In the very high-end segment i.e. between 10 and 50 million Euros, we saw a surprising amount of activity, in fact the strongest for over twenty years. In 2018, our Paris agencies completed over ten sales of between 10 million Euros and 50 million Euros including: 48.5 million Euros for an exceptional private house on the Left Bank, 20 million Euros for a superb apartment in the 7th, 20 million Euros for a historic private house in the 6th, 20 million Euros for a duplex apartment on Avenue Foch in the 16th, 16.5 million Euros for a stylish private house in the 8th, 12 million Euros for a private house on Avenue Hoche in the 8th, 11.8 million Euros for a private house in the 17th, and 10 million Euros for an apartment on the Avenue Foch in the 16th.

What is happening to prices?

We saw a rise of 5% in 2018. We also set a new record for a Parisian property: €52,000/m² for a private house on the Left Bank. Most prestigious Parisian properties sold for between €12,000 and 15,000/m² and sales over €20,000/m² were far more common this year.

What are the major trends?

In 2018, the market was dominated by French buyers (about 65% vs. 50% normally): buyers already residing in France but also expats returning to France from London, also buyers from Asia, Europe and the Middle East. Globally, 2018 has been a remarkable year with significant changes in the rankings of the world's most prestigious markets: three of the highest and most stable markets in history - New York, London and Hong Kong - are slowing down while Paris experienced a rebirth with rising activity and prices. While the price gap between Paris and these cities is decreasing, it remains significant.

In your opinion, are there opportunities for luxury properties in Paris?

Although buyers are looking for turnkey properties in the most popular neighbourhoods (6th, 7th, 8th), the opportunities are for properties requiring work in certain neighbourhoods. I see a lot of potential in the 16th and 17th as these neighbourhoods have beautiful properties, which are cheaper thanks to their large size. Today, especially sought-after by families wanting large living spaces and a very good quality of life, these neighbourhoods are changing with the arrival of more prestigious shops, fine-dining restaurants and luxury hotels attracting a foreign clientele. There is also a gentrification phenomenon in less prestigious neighbourhoods: the 11th has seen an influx of buyers, especially young French people not able to find a suitable property in the 4th (one of the most sought after districts) and attracted by more affordable prices, unusual properties and more space. We are seeing the same in the 14th and 15th districts.

How is 2019 looking for your sector?

While the first quarter is usually calm, 2019 hit the ground running in the first few weeks; our Paris agencies have already made sales (under offer) of over 80 million Euros! In 2018, Brexit only had a limited impact on the top-end Parisian market contrary to many forecasts. Although we have seen a number of French expats leaving London, this has not contributed much to the significant increase in the Parisian market. But the prospect of a ‘Hard Brexit’, which has become more likely, should slow down the London market and accelerate the exodus of French expats. For now, I have not seen any real negative impact following the ‘yellow vest’ movement on the luxury real estate market. However, it is hoped that the situation will calm down and that it will not have a negative impact on France’s image around the world. Finally, I don’t believe that a slight rise in interest rates will have a significant effect on the Paris market as they remain low. Consequently, I am optimistic - even very optimistic - for 2019!

Olivier Marin

copyright photos : Emeric Fohlen, Philippine Chauvin et Stéphane Durieu

Olivier Marin

:strip_icc()/https%3A%2F%2Fproperties.lefigaro.com%2Fimages%2FPDF%2FCMS%2Feditions%2F911498890-1553705751.99.jpg)