- rooms3

- bedrooms2

- Area56 m²

- Construction2023

- ConditionN/A*

- Floor2nd

- No of floors3

- Parking1

- bathroomN/A*

- Shower room2

- Toilets2

- ExposureSouth

- HeatingElectric

- KitchenN/A*

- Property tax$973

ApartmentLe Monêtier-les-Bains (05) Price : $304,400

MORE THAN A STATION: A REAL MOUNTAIN VILLAGE

Located in the heart of the beautiful village of MÔNETIER-LES-BAINS (05 220), just minutes on foot from the village church and positioned between the Grenoble road (on the Briançon side of the village) and the Rochebrune road, the residence is ideally located, surrounded by multiple chalets and fir trees. You will have an unobstructed view of the mountains (see attached video). 100m away, you will find the Post Office and the first shops in the village; 1km away: the Grands Bains de Monêtier and ski slopes (downhill, Nordic, and children’s area).

REHABILITATION OF THE AUBERGE DE VIOLAINE

We are undertaking an important rehabilitation operation on the Auberge de Violaine, a renowned establishment in the municipality for many years. Delivery is scheduled for the second half of 2023. The residence will consist of 17 apartments ranging from Studio to T5, with private parking, cellars, and heated ski lockers. We present this duplex T2-3 for 6 to 8 sleepers, with a surface area of 56.77 m² and 41.30 m² according to the Carrez Law. It is located on the 2nd floor, facing South. It is very well organized as a duplex and will be a warm and comfortable apartment.

High-end features:

- Secured gate at the entrance of the residence

- Sauna space

- Indoor elevator

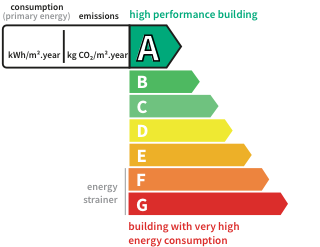

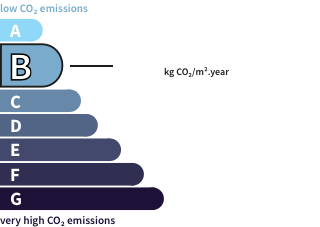

- Insulation equivalent to new (according to existing building RT standards)

- Individualization of water and electrical systems

- Gray anthracite aluminum joinery

- Wood cladding on one wall of the living area

- Premium LVT flooring, parquet look in living areas, light gray in bathrooms, wall tiles

- Suspended toilets

- Fitted wardrobes

- Extra-flat shower tray or bathtub according to plans

- Individual water heater

- Electric heating

- Equipped kitchens + complete furniture (optional)

PARAHOTEL SERVICES: CONCIERGE ON SITE / FREE OCCUPATION

The VALLAT concierge, specialized in managing high-end properties in the mountains, will be on site during the opening periods of the station and will take care of:

- Marketing stays on specialized platforms (Booking, Airbnb, Abritel, Expedia…) and also negotiating with tour operators or works councils to optimize occupancy

- Providing para-hotel services:

- Personalized welcome

- Regular cleaning of premises

- Provision of bedding and towels

- Possible provision of breakfast

It should be noted that this is not the establishment of a lease but rather a concierge mandate, with only 21% on the stays carried out.

Finally, very importantly, you can occupy the property as you wish.

ADVANTAGEOUS TAXATION

As you will see, the taxation on parahotellerie with hotel services is very advantageous in many respects:

- Recovery of VAT, which is 20% of the acquisition price, in full within 6 months following the deed at the notary.

- No income tax on the income generated from the rental

- Amortization of the property allowing the creation of an accounting deficit

- No capital gains tax on resale after 5 years of operation

Also, to revisit the legal and tax setup we present (which is not mandatory but we recommend), you need to set up a Sole Proprietorship (or LLC or SAS, but not SCI), in B.I.C Pro, with the social object of hotel accommodation with hotel services, and that you (with the concierge) are able to provide at least 3 of the 4 services regularly (welcome, provision of linens, regular cleaning, breakfast). You will therefore benefit from the following tax provisions:

- Subject to VAT

- Recovery of the 20% VAT on the property (with definitive acquisition of 1/20 each year)

- Recovery of VAT on the furniture package and all other charges (notary fees, co-property, accounting, electricity, water…)

- Collection of 10% VAT on stays billed to your clients

- All charges are deductible + accounting depreciation of the property

- The net price of the property is depreciable over a minimum of 20 years, which creates a (so-called fictitious) charge that will make your accounting result negative each year (unless you exceptionally rent the property).

Since this is a professional activity, all charges are deductible: notary fees, co-property, property tax, business tax, flat URSSAF (if set up as EI or LLC), travel expenses to get there for professional reasons, loan interest…

Integration of the activity result into your Reference Tax Income (RFR)

Like any professional activity, you must integrate the result (in this case the deficit) into your RFR, which will lower your taxable base for income tax and reduce your tax from the highest marginal bracket (40% or 30%).

Exemption from capital gains tax after 5 years

Like any merchant who sells their business after 5 years of activity and who generates less than €250,000 in annual turnover.

Catherine Médina

Information about the risks to which this property is exposed is available on the Georisque website: georisques.gouv.fr

Catherine Medina - EI - is a Commercial Agent authorized in real estate, registered in the Special Register of Commercial Agents of the Manosque Commercial Court under number . Headquarters of the principal: effiCity, 48 avenue de Villiers - 75017 PARIS - Simplified Joint Stock Company, capital of €132,373.05, registered in the Paris RCS 497 617 746 and holder of the Professional Card CPI 7501 2015 000 002 025 - CCI Paris IDF - Guarantee Fund: GALIAN Assurances 89 rue de la Boétie 75008 Paris

This description has been automatically translated from French.

Its assets

- Elevator

- Garage & Parking

- Handicapped Accessible

In detail

Apartment Le Monêtier-les-Bains (05)

By confirming this form, I agree to the General Usage Terms & Conditions of Figaro Properties.

The data entered into this form is required to allow our partner to respond to your contact request by email/SMS concerning this real estate advertisement and, if necessary, to allow Figaro Classifieds and the companies belonging to its parent Group to provide you with the services to which you have subscribed, e.g. creating and managing your account, sending you similar real estate advertisements by email, proposing services and advice related to your real estate project.

Visit this apartment

Contact an advisor

By confirming this form, I agree to the General Usage Terms & Conditions of Figaro Properties.

The data entered into this form is required to allow our partner to respond to your contact request by email/SMS concerning this real estate advertisement and, if necessary, to allow Figaro Classifieds and the companies belonging to its parent Group to provide you with the services to which you have subscribed, e.g. creating and managing your account, sending you similar real estate advertisements by email, proposing services and advice related to your real estate project.

Photograph this QR Code with your phone to visit the listing